Designing a product

Together with the product team, we gathered all the research findings, synthesised them, and then created the new product and its features while taking the study findings and all potential user scenarios into consideration.

Design outcome 1

We discovered throughout the research phase that people are unaware of the features of the product. We thus develop certain concepts to demonstrate their value proposition to users during onboarding in order to achieve this.

Design outcome 2

In the second phase, we created several high-fidelity screens to enhance the app's user experience and address the issues we discovered during the research phase.

Designing a product

Together with the product team, we gathered all the research findings, synthesised them, and then created the new product and its features while taking the study findings and all potential user scenarios into consideration.

Design outcome 1

We discovered throughout the research phase that people are unaware of the features of the product. We thus develop certain concepts to demonstrate their value proposition to users during onboarding in order to achieve this.

Design outcome 2

In the second phase, we created several high-fidelity screens to enhance the app's user experience and address the issues we discovered during the research phase.

Designing a product

Together with the product team, we gathered all the research findings, synthesised them, and then created the new product and its features while taking the study findings and all potential user scenarios into consideration.

Design outcome 1

We discovered throughout the research phase that people are unaware of the features of the product. We thus develop certain concepts to demonstrate their value proposition to users during onboarding in order to achieve this.

Design outcome 2

In the second phase, we created several high-fidelity screens to enhance the app's user experience and address the issues we discovered during the research phase.

Usability testing

Usability testing

Usability tests where done with current & potential customers on 3 key flows to understand problems, opportunity for improvement & reason for drop off.

Usability tests where done with current & potential customers on 3 key flows to understand problems, opportunity for improvement & reason for drop off.

The term “send” could be rephrased to “receive/accept” in the penny verification screen

Present all loan details (fees, interest, instalments, and late fees) on the onboarding dash (unlock offer)

Introduce Key features (multiple withdrawal, early repayment, payment methods) during onboarding

The term “send” could be rephrased to “receive/accept” in the penny verification screen

Present all loan details (fees, interest, instalments, and late fees) on the onboarding dash (unlock offer)

Introduce Key features (multiple withdrawal, early repayment, payment methods) during onboarding

The term “send” could be rephrased to “receive/accept” in the penny verification screen.

Present all loan details (fees, interest, instalments, and late fees) on the onboarding dash (unlock offer).

Introduce Key features (multiple withdrawal, early repayment, payment methods) during onboarding.

Impact

Impact

Telephonic interviews was conducted to measure the product impact on the users

Telephonic interviews was conducted to measure the product impact on the users

7%

Utilisation: Increase in average utilisation rate of the credit line form 87% to 94% in the last 4 months. Utilisation rate has remained steady over the last 4 months

Utilisation: Increase in average utilisation rate of the credit line form 87% to 94% in the last 4 months. Utilisation rate has remained steady over the last 4 months.

Utilisation: Increase in average utilisation rate of the credit line form 87% to 94% in the last 4 months. Utilisation rate has remained steady over the last 4 months.

50%

Drop offs: At the KYC stage. UX improvements increased KYC completions from 45% TO 86%

Drop offs: At the KYC stage. UX improvements increased KYC completions from 45% to 86%.

Drop offs: At the KYC stage. UX improvements increased KYC completions from 45% TO 86%.

40%

40% up self-repayment: increase usage of the self repayment feature from 10% to 50% through UX improvements. this in turn can prevent dues from accruing & reduce risk for the provider

Self-repayment: increase usage of the self repayment feature from 10% to 50% through UX improvements. this in turn can prevent dues from accruing & reduce risk for the provider

Self-repayment: increase usage of the self repayment feature from 10% to 50% through UX improvements. this in turn can prevent dues from accruing & reduce risk for the provider.

Project introduction

A 3 phased project to accommodate for the different stages of development of the product. The company is seeking a partner who can be flexible and adapt quickly to changing requirement during the pilot phase with new platform partners

Phase 1

Asses the new products market viability and conceptualisation

Phase 2

Usability tests to refine and validate the products UX

Phase 3

Understand the impact generated among users after the pilot is complete

Qualitative research

1:1 interviews was conducted with platform workers across different platform to understand

How they managed money-in & money-out?

Liquidity needs & financial goals.

Credit mental model.

1:1 interviews was conducted with platform workers across different platform to understand

How they managed money-in & money-out?

Liquidity needs & financial goals.

Credit mental model.

Tools use in research are:

Mind map - Key words to elicit responses from the user Explorative Qs asked on the response will encourage user stories

Show me how - How they interact with platforms over their phones for financial transactions

Journey line - Map out the user money in&out transaction understand planned versus unforeseen across time horizon(week, month, quarters)

Project introduction

A 3 phased project to accommodate for the different stages of development of the product. The company is seeking a partner who can be flexible and adapt quickly to changing requirement during the pilot phase with new platform partners.

Phase 1

Asses the new products market viability and conceptualisation.

Phase 2

Usability tests to refine and validate the products UX.

Phase 3

Understand the impact generated among users after the pilot is complete.

Qualitative research

1:1 interviews was conducted with platform workers across different platform to understand

How they managed money-in & money-out?

Liquidity needs & financial goals.

Credit mental model.

1:1 interviews was conducted with platform workers across different platform to understand.

How they managed money-in & money-out?

Liquidity needs & financial goals.

Credit mental model.

Tools use in research are:

Mind map - Key words to elicit responses from the user Explorative Qs asked on the response will encourage user stories

Show me how - How they interact with platforms over their phones for financial transactions

Journey line - Map out the user money in&out transaction understand planned versus unforeseen across time horizon(week, month, quarters)

Mind map - Key words to elicit responses from the user Explorative Qs asked on the response will encourage user stories.

Show me how - How they interact with platforms over their phones for financial transactions.

Journey line - Map out the user money in&out transaction understand planned versus unforeseen across time horizon(week, month, quarters).

Phase 1

Asses the new products market viability and conceptualisation

Phase 2

Usability tests to refine and validate the products UX

Phase 3

Understand the impact generated among users after the pilot is complete

Project introduction

A 3 phased project to accommodate for the different stages of development of the product. The company is seeking a partner who can be flexible and adapt quickly to changing requirement during the pilot phase with new platform partners

Process

Map out a person's income from the platform and from other sources, their costs, and eventually a balance sheet. This would give information about how users behave and think about managing their finance.

Collected insights on user behaviour during the product's pilot testing phase.

Identified the reasons for drop off during the onboarding

Map out a person's income from the platform and from other sources, their costs, and eventually a balance sheet. This would give information about how users behave and think about managing their finance.

Collected insights on user behaviour during the product's pilot testing.

Identified the reasons for drop off during the onboarding.

Outcomes of the research

Outcomes of the research

Outcomes of the research

Opportunities found through the interviews

Opportunities found through the interviews

Opportunities found through the interviews :

The liquidity needs upto 10,000-15,000 were not useful, but useful to target segment to meet frequently arising needs like vehicle maintaince, mobile repairs/purchase, to lend to friends, for policy installments etc.

The liquidity needs upto 10,000-15,000 were not useful, but useful to target segment to meet frequently arising needs like vehicle maintaince, mobile repairs/purchase, to lend to friends, for policy installments etc.

It is important to establish a good reputation or "social currency" in their line of work as it will make it easier for them to borrow money from friends and peers in case of unexpected expenses. Without a strong social currency, it can be challenging for new platform workers to manage their finances during unplanned expense

It is important to establish a good reputation or "social currency" in their line of work as it will make it easier for them to borrow money from friends and peers in case of unexpected expenses. Without a strong social currency, it can be challenging for new platform workers to manage their finances during unplanned expense

It is important to establish a good reputation or "social currency" in their line of work as it will make it easier for them to borrow money from friends and peers in case of unexpected expenses. Without a strong social currency, it can be challenging for new platform workers to manage their finances during unplanned expense.

Platform workers have concerns around borrowing large amounts or salary advances through their employers due to lack of a direct line of communication or effective grievance redressal portal

Platform workers have concerns around borrowing large amounts or salary advances through their employers due to lack of a direct line of communication or effective grievance redressal portal

Platform workers have concerns around borrowing large amounts or salary advances through their employers due to lack of a direct line of communication or effective grievance redressal portal.

Collective persona

Collective persona

Users were distributed across the developing personas based on:

Demographics: Age, education, etc.

Responsibility: dependents, primary earner etc.

financial behaviour: saves, owns financial instruments etc.

Users were distributed across the developing personas based on:

Demographics: Age, education, etc.

Responsibility: dependents, primary earner etc.

financial behaviour: saves, owns financial instruments etc.

Users were distributed across the developing personas based on:

-Demographics: Age, education, etc.

-Responsibility: dependents, primary earner etc.

-Financial behaviour: saves, owns financial instruments etc.

Persona 1:

casual approach to their finance as they have their family to support

Don’t save and enjoy their financial freedom to spend

Persona 1:

casual approach to their finance as they have their family to support

Don’t save and enjoy their financial freedom to spend

Persona 2 :

Methodical approach to finances is planned and budget in their expenses

Work multiple jobs to manage cash flows

Persona 2 :

Methodical approach to finances is planned and budget in their expenses

Work multiple jobs to manage cash flows

Persona 3 :

Tend to be very careful with their money and have all of their expenses well planned.

Highly disciplined approach to work to meet their needs

Persona 3 :

Tend to be very careful with their money and have all of their expenses well planned.

Highly disciplined approach to work to meet their needs

Persona 4 :

Financial discipline of saving and investing

They have comfort in the hours they are putting in for work

Persona 4 :

Financial discipline of saving and investing

They have comfort in the hours they are putting in for work

Persona 1:

-Casual approach to their finance as they have their family to support.

-Don’t save and enjoy their financial freedom to spend.

Persona 2 :

-Methodical approach to finances is planned and budget in their expenses.

-Work multiple jobs to manage cash flows.

Persona 3 :

-Tend to be very careful with their money and have all of their expenses well planned.

-Highly disciplined approach to work to meet their needs.

Persona 4 :

-Financial discipline of saving and investing.

-They have comfort in the hours they are putting in for work.

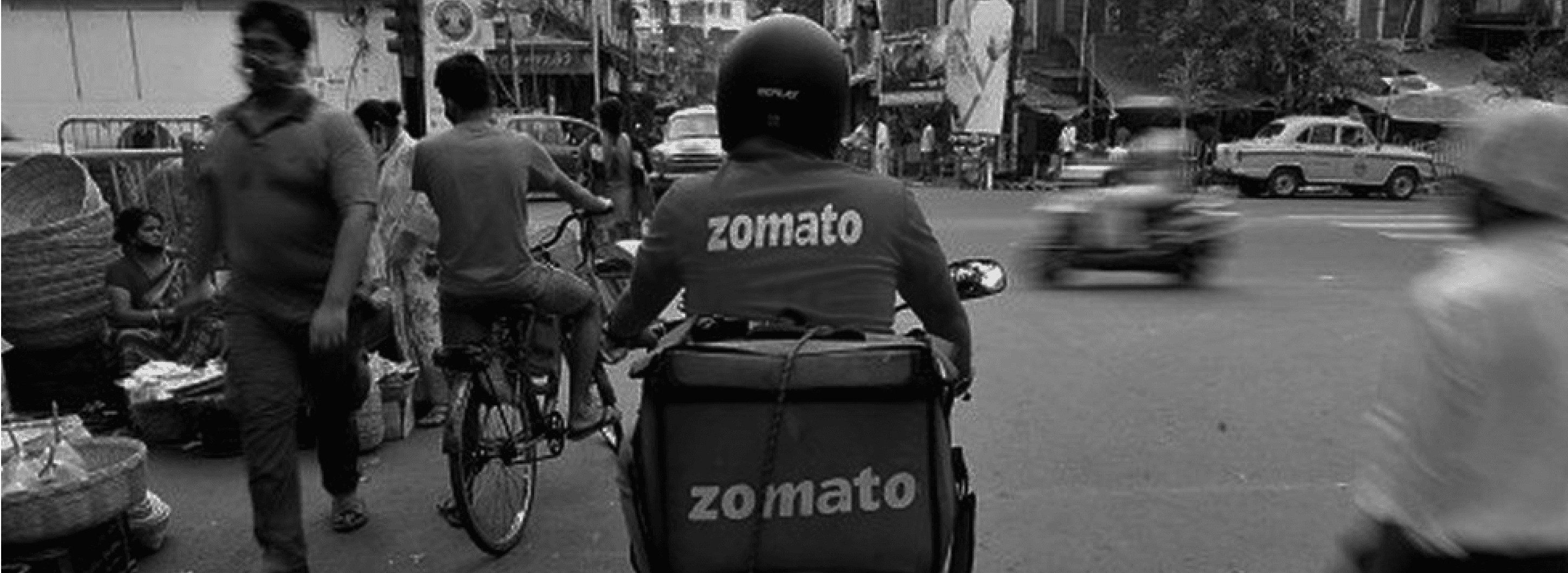

Category : Design Research & UX Design

Duration: 9 months

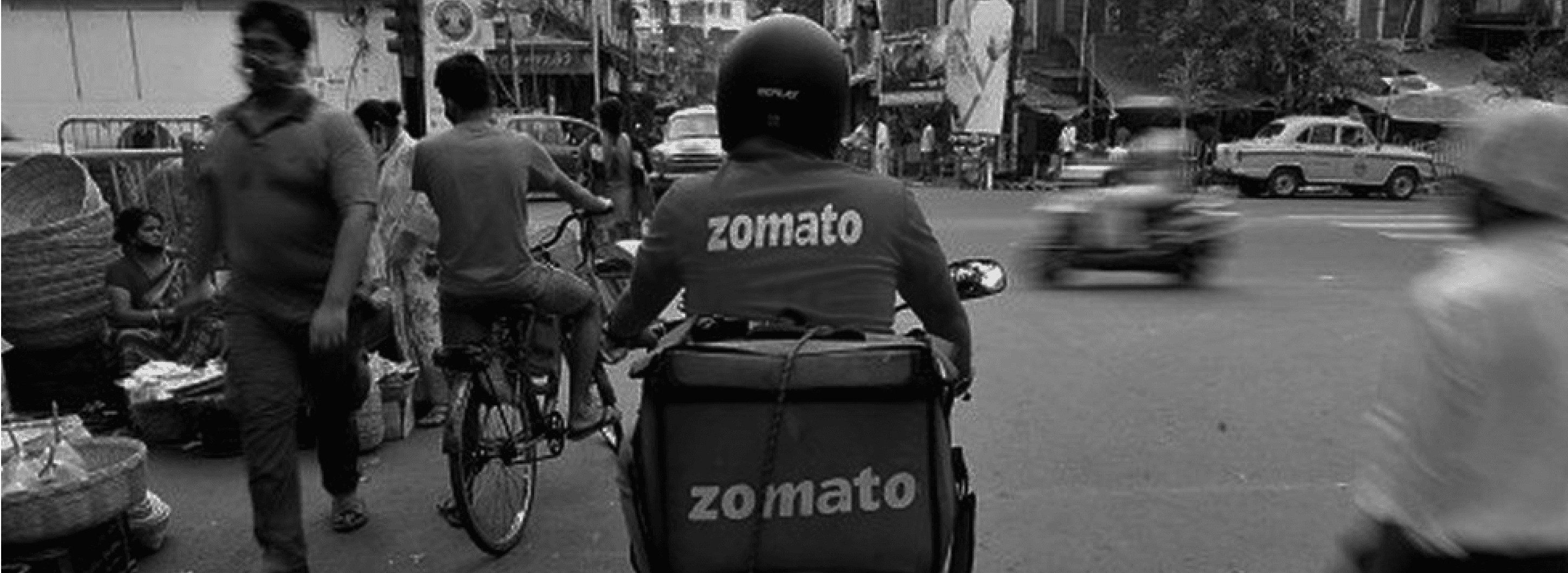

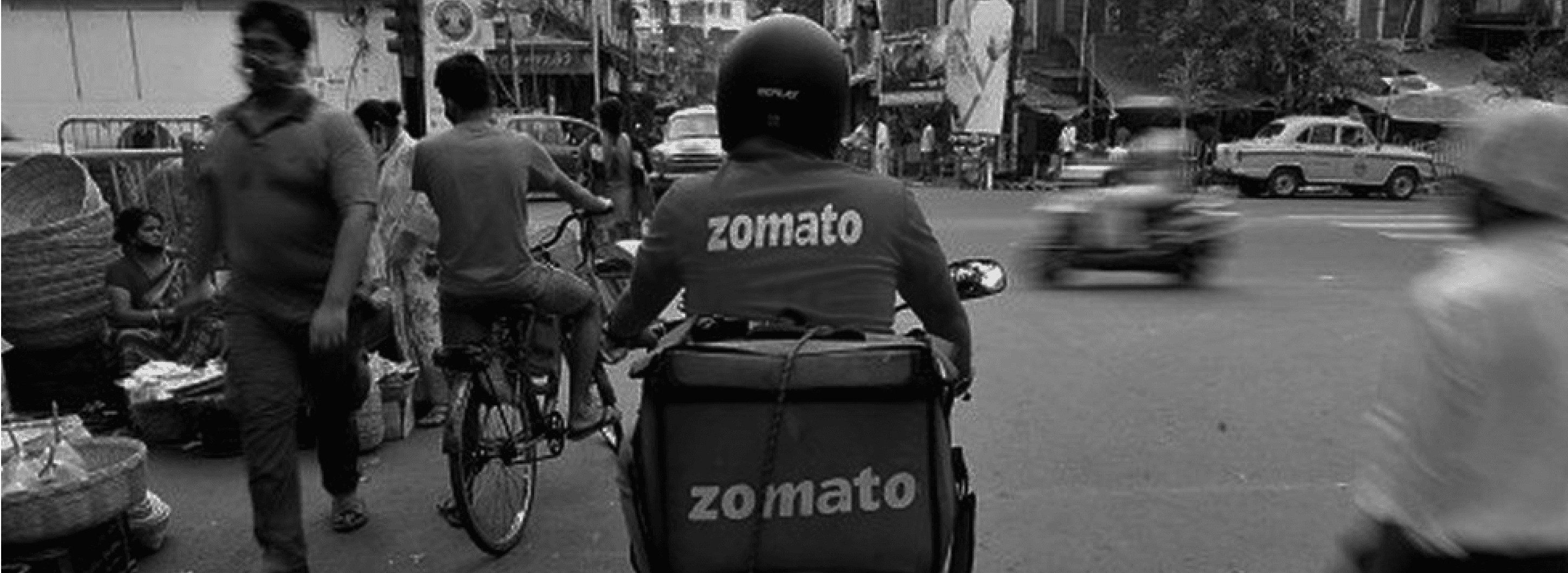

Elevating Gig workers financial stability: A research and UX design project on Financial services

Category : Design Research & UX Design

Duration: 9 months

Elevating Gig workers financial stability: A research and UX design project on Financial services

Project background

An Indian fintech company that provides financial services to platform workers aims to test the market fit of a new financial product by conducting research, collecting data and synthesizing the information, and then iterating on the product design before making it available to the audience

An Indian fintech company that provides financial services to platform workers aims to test the market fit of a new financial product by conducting research, collecting data and synthesizing the information, and then iterating on the product design before making it available to the audience

My responsibilities included conducting user interviews, conceptualising, conducting usability tests, and evaluating the project's impact.